1. Introduction

The Board of Directors ("the Board") of WCT Holdings Berhad ("WCT" of "the Company") is primarily responsible for the business and affairs of the Company and strongly believes that good corporate governance is vital to sustain its value and enhancing business integrity apart from maintaining confidence of shareholders/ investors in WCT Group achieving its corporate objectives and vision.

The Board Charter sets out the roles, responsibilities, functions, compositions, processes and operations of the Board as well as those functions delegated to the Board Committees and the Management of WCT Group and is subject to the provisions of the Constitution of the Company, the Companies Act 2016, Main Market Listing Requirements (“MMLR”) of Bursa Malaysia Securities Berhad (“Bursa Securities”), the Malaysia Code on Corporate Governance (“the Code”) and any other applicable laws or regulatory requirements .

2. Purpose

This Board Charter is to promote a high standard of corporate governance within WCT Group and to ensure the Board is aware of their roles and responsibilities as well as the principles of good corporate governance and practices adopted in accordance with applicable laws in Malaysia when they are acting on behalf of the Company.

In addition, the Board Charter also serves as a primary source of reference and induction literature for the Board as well as to assist the Board in the assessment of its own performance and that of its individual director.

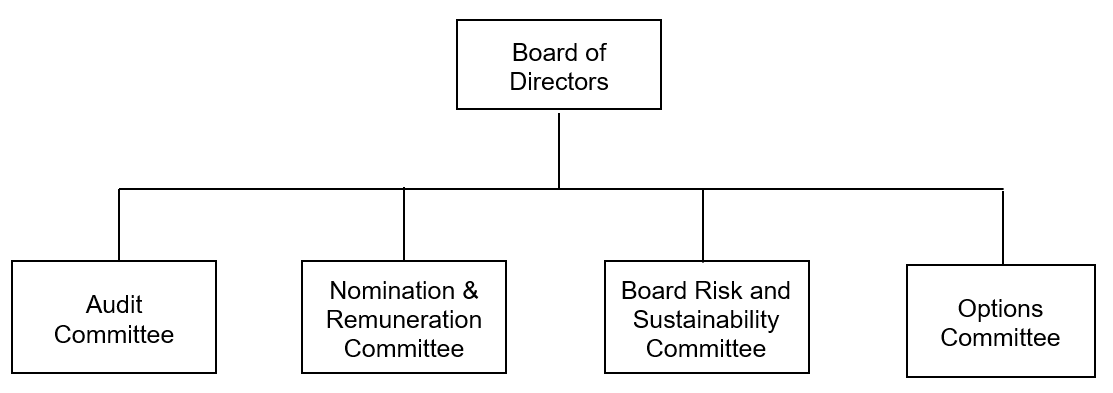

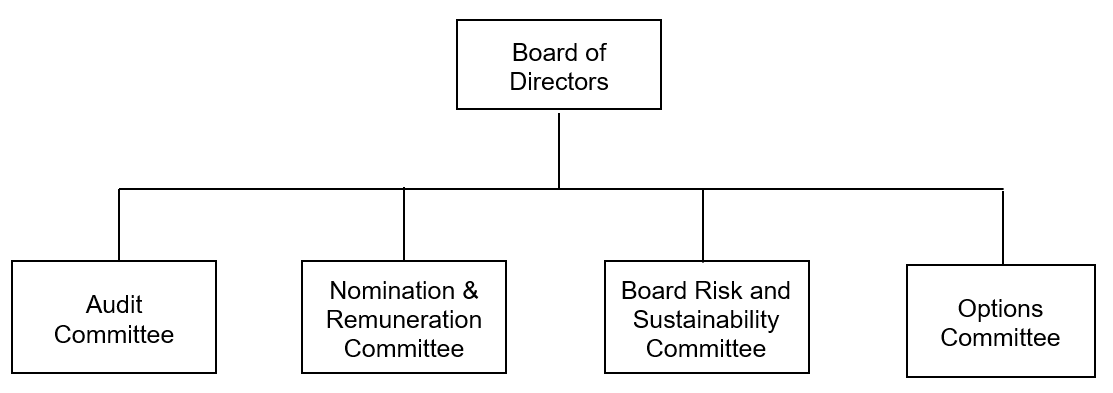

The governance structure of the Board is as follows:

3. The Board

Composition

The Board shall be of a size and composition with a diverse set of skills, knowledge, professional/industry experiences, gender, age, cultural and educational backgrounds, ethnicity and length of service that ensure sufficient diversity and independence so as to effectively discharge the Board's roles and responsibilities for the benefit of the Company and its business.

The Company’s Constitution provides that the number of directors of the Company shall not be less than two (2) and unless otherwise determined by a meeting of shareholders, not more than twenty (20).

The position of the Chairman and the Managing Director shall be assumed by different persons with a clear division of power and responsibilities to ensure a balance of power and authority as well as a clear demarcation of power between strategy and policy making process and the day-to-day management of the Company.

The Board must ensure that at least two (2) or one-third (1/3) of its board members (whichever is higher) are Independent Directors and has at least one (1) woman director. If a vacancy in the Board results in a non-compliance with these requirements, the vacancy must be filled within three (3) months.

The Independent Directors are expected to provide independent judgement, experience and objectivity without being subordinated to operational considerations as well as to ensure that the interests of all shareholders are protected, and that the relevant issues are subjected to objective and impartial consideration by the Board.

A Director is considered to be independent if the Director satisfies the criteria for independence as prescribed in Paragraph 1.01 and Practice Note 13 of the MMLR of ("Bursa Securities") and where the Director is independent of management and free from any business or other relationship that could materially interfere with the exercise of independent judgement or the ability to act in the best interest of the Company.

The tenure of an Independent Director shall not exceed a cumulative term of twelve (12) years. In the event the Board intends to retain the Independent Directors upon the completion of serving a cumulative term of nine (9) years, the Board shall seek shareholders’ approval in accordance with the recommendations of the Code provided the tenure does not exceed a cumulative term of 12 years.

The Board is committed to embrace diversity in the Board composition as further set out in the

Board and Senior Management Diversity Policy.

The composition and size of the Board are reviewed from time to time to ensure the Board is of an appropriate range and balance of skills, experiences, independence, background of the Board and diversity.

Senior Independent Director

A Senior Independent Director shall be appointed by the Board with the roles amongst others are as follows:

(i) to act as sounding board for the Chairman;

(ii) to act as an intermediary for other directors when necessary; and

(iii) to act as a designated contact person to attend to any query or concern raised by the shareholders or stakeholders.

Appointment and Re-election

The Board has the power under the Company’s Constitution to appoint a director from time to time either to fill a casual vacancy or as an additional director. Any director so appointed shall hold office only until the next following Annual General Meeting ("AGM") and shall then be eligible for re-election at the AGM.

The selection and appointment of a new member to the Board is made only with the recommendation from the Nomination & Remuneration Committee based on his/her merits and potential contribution which he/she brings to the Board having due regard to the benefit of diversity and the depth of experience of the Board.

Further, the Company's Constitution requires that the number of directors nearest to, but not greater than one-third (1/3) shall retire by rotation each year and being eligible, may offer themselves for re-election at the next AGM. In addition, all the directors are required to retire from office at least once in every three (3) years but shall be eligible for re-election, where applicable.

A director who is subject to retire from office by rotation but does not offer himself for re-election shall retire at the conclusion of the next AGM.

A fit and proper assessment on any person identified to be appointed as a Director or for re-election as a Director shall be conducted prior to the initial appointment or proposed re-election as Director. The NRC and the Board shall be guided by the

Directors’ Fit and Proper Policy in conducting the said fit and proper assessment.

New Directorship

Pursuant to the MMLR of Bursa Securities, the Directors of the Company must not hold more than five (5) directorships in public listed companies.

The members of the Board shall notify the Chairman and the Board before accepting any new directorship in other public listed companies and shall include an indication of time that will be spent on the new appointment.

4. Role of the Board

The Board plays an important role in the stewardship of the Company’s direction and operations. It focuses mainly on strategies and oversight on the Group’s financial performance and critical business issues. The Board is supported by the Executive Directors and the Management, whose responsibilities are to implement WCT Group's business plans and strategies and manage the operations of the Group, subject to the appropriate authority limits as approved by the Board.

The principal roles and responsibilities of the Board, among others, are as follows:

To review and if thought fit, approve the Management’s strategic action plans which have long term value creation and include strategies on environmental and social consideration underpinning sustainability.

To monitor the implementation of the strategic action plans by the Management on a regular basis.

To promote good corporate governance culture within the Group which reinforces ethical, integrity, prudence and professional behaviour.

To oversee the conduct of WCT Group's businesses and to evaluate whether the businesses are being properly managed in line with the Group’s policies and procedures as well as any relevant rules and regulations.

To provide oversight over the adequacy and integrity of the Group’s internal control systems and to ensure the implementation of appropriate internal controls and mitigation measures.

To provide oversight over the risk management systems of the Group, including the management of principal risks affecting the Group’s businesses, setting the appropriate risk appetite for the risk management framework as well as to monitor significant financial and non-financial risks affecting the Group.

To put in place a succession plan, including the appointment of senior management and to provide them with appropriate guidance as and when needed.

To monitor and review the Group’s policy and procedures for effective communication with the stakeholders.

To monitor and review the management processes aimed at ensuring the integrity of financial and non-financial reporting with the guidance of the Audit Committee.

To monitor and review the policies and processes relating to quality, safety & health, environmental and the compliance with relevant laws and regulations.

To establish appropriate ethical standards and behaviour and an appropriate code of conduct and integrity for adherence by the Directors, Management and employees at all times.

The Board may, subject to their responsibilities, from time to time delegate specific functions to a Board Committee, a Director, employee or any other person to assist them in the discharge of their duties and responsibilities, as and when required.

Matters which are specifically reserved for the Board's deliberation and decision making, amongst others, include the following:

To approve strategic action plans, annual business plans and financial budget prepared by the Management.

To approve material acquisitions and material disposals of WCT Group's undertaking and assets.

To approve major investments, divestments, mergers and acquisitions, corporate restructurings, joint ventures and strategic alliances.

To approve the Management structure and the threshold/authority limits delegated to the Management for day-to day business operations.

To approve the appointment, resignation/termination of directors, company secretaries and other senior management position of the Company.

To approve any related party transactions as defined in the MMLR.

To approve the interim dividend and the recommendation of final dividend for shareholders' approval.

To establish board committee and delegation of authorities to such committee to carry out certain functions and responsibilities on behalf of the Board.

To approve the major capital expenditure and capital management.

To approve the annual audited financial statements and quarterly unaudited financial statements prior to the release to Bursa Securities.

Any other matters that the Board may deem necessary from time to time.

5. Role of the Chairman

The Chairman is primarily responsible for ensuring the Board's effectiveness and conduct as well as facilitating constructive deliberation of all matters presented to the Board.

The responsibilities of the Chairman include, amongst others, the following:

(a) As a leader of the Board and is responsible for the development needs of the Board.

(b) To maintain constructive and respectful relationships between the Directors and between the Board and the Management.

(c) Leading the Board in establishing and monitoring good corporate governance practices in the Group.

(d) Setting the board agenda and ensuring the Board receive complete and accurate information in a timely manner.

(e) To represent the Company at shareholders' meetings and to ensure an effective communication between the Company and the shareholders and stakeholders.

(f) To manage the boardroom dynamics by promoting a culture of openness and debate.

(g) To oversee the annual evaluation of performance of the Board, Board Committees and individual directors as well as to discuss the performance and assessment with the individual director concerned and the chairman of the respective Board Committees.

(h) To facilitate the constructive and effective contributions from all the Directors at the Board meetings.

6. Managing Director

The Managing Director has an overall responsibility for the business and operation units, organisational effectiveness and implementation of the Board's policies, strategic plans and decisions.

The responsibilities of the Managing Director include, amongst others, the following:

(a) To develop and implement the policies and strategic action plans for the Group.

(b) To develop and implement long term and short-term business plans to achieve the Group's objectives in terms of growth and profitability aimed at building sustainable value for shareholders and stakeholders.

(c) To co-ordinate the business plans and strategies with the respective heads of business and operation units and divisions to ensure the same are implemented effectively.

(d) To communicate effectively the Company's vision, mission, core value as well as management philosophy and strategic action plans to the employees.

(e) To assess any business opportunities and investments with potential benefits and within the Group's objectives.

(f) To keep the Board informed of important and material developments/matters relating to the Group's business operations on an accurate and timely basis.

(g) To maintain good relationship with employees and to provide a healthy and safe working environment for the employees.

(h) To ensure the Group complies with relevant laws and regulations.

The Managing Director may delegate specific functions to the Deputy Managing Director, an Executive Director and any member of the Management to assist him/her in discharging his/her duties and responsibilities.

7. Board Committees

The Board may from time to time establish a committee as it considers appropriate to assist the Board in discharging its duties and responsibilities.

The Board Committees shall operate within the defined roles and responsibilities as set out in their terms of reference as approved by the Board. The chairman of the respective Board Committee reports/updates the Board on the outcome of the Board Committee meetings and the minutes of every Board Committee's meetings shall be escalated to the Board for notation.

The Board has established the following Board Committees with written terms of reference, which shall be periodically reviewed and updated as required, to assist the Board in furtherance of its duties:

Audit Committee (“AC”)

The AC of the Company shall have at least three (3) members comprising independent and/or non-executive Directors of the Company. All AC members must not hold any executive position in the Group and a majority of the AC shall consist of independent directors who meet the criteria as set out in the MMLR of Bursa Securities. At least one of the members of the AC must be a member of the Malaysian Institute of Accountants (“MIA”) or if not a member of MIA, must have met the minimum requirements as set out in the MMLR of Bursa Securities.

The AC is to assist the Board in fulfilling its responsibilities relating to the Group's financial reporting and internal control systems. The AC reviews the annual financial statements, quarterly unaudited financial results, audit reports, the related party transactions, assess the independence of internal and external auditors, the adequacy and effectiveness of internal control systems of the Group which include the anti-bribery and anti-corruption control measures.

Board Risk and Sustainability Committee (“BRSC”)

The BRSC shall have at least three (3) members comprising independent and/or non-executive Directors. All BRSC members must not hold any executive position in the Group and a majority of the BRSC shall consist of independent directors.

The BRSC is to assist the Board in overseeing the risk management activities of WCT Group and approving appropriate risk management procedures and methodologies across the Group, including overseeing the compliance management system relating to the anti-bribery and anti-corruption (as guided by the Board’s approved

Policy on Anti-Bribery and Anti-Corruption). In addition, BRSC is also responsible to oversee sustainability-related risks and ensure that sustainability considerations are incorporated in the Group’s businesses and strategies so as to create value for its businesses and stakeholders in the longer terms as well as to support business continuity and competitiveness over the longer term.

Nomination and Remuneration Committee ("NRC")

The NRC shall have at least three (3) members comprising independent and/or non-executive Directors. All NRC members must not hold any executive position in the Group and a majority of the NRC shall consist of independent directors who meet the criteria as set out in the MMLR of Bursa Securities.

The NRC is to assist the Board in identifying and to recommend for the Board's approval new appointments and/or re-elections of Directors, review the terms of employment and propose remuneration for Directors as well as the diverse set of skills, knowledge, professional/industry experiences, gender, age, cultural and educational backgrounds, ethnicity and length of service of the Directors.

The NRC also assesses the effectiveness of the Board as a whole, the Board Committees as well as the performance of each individual Director on an annual basis. The NRC shall recommend to the Board in engaging professional independent party to facilitate the annual assessment as and when the NRC deems necessary.

The NRC shall be guided by the Board’s approved Policy on

Remuneration of Directors and Senior Management, the objective of which is to attract and retain Directors (including Senior Management) who are required to lead the Group effectively.

Options Committee (“OC”)

The OC shall have at least three (3) members and comprising at least one Independent Non-Executive Director. The chairman of the OC shall be an Independent Non-Executive Director.

The OC is responsible for administering the Company's Employees' Share Options Scheme (2013/2023) ("Scheme") in accordance with the objectives and regulations thereof and to determine the eligibility, option offers, option allocations and attend to such other matters as may be required subject to the Scheme's By-Laws as approved by the Board and the shareholders of the Company.

8. Board and Board Committee Evaluation

The Board, through the NRC, shall assess and evaluate the performance and effectiveness of the Board as a whole, the Board Committees and individual directors annually. The Board shall engage professional independent party to conduct and facilitate an objective and candid board evaluation periodically or as and when the Board deems necessary.

The Board also reviews and assesses the independence of each existing Independent Director of the Company annually, prior to his/her appointment for new appointment and when any new interest or relationship develops between the Independent Director and the Company or its subsidiaries.

The assessment results from the annual evaluation form the basis of the NRC’s recommendation to the Board for the re-election of Directors as well as for further development of the Directors.

Board Meetings

The Board shall meet at least four (4) times a year with additional meetings to be convened and held as deemed necessary by the Board.

The quorum necessary for the transaction of any business deliberated at a Board Meeting shall be two (2). The Chairman of a Board Meeting shall have a second or casting vote unless where only two (2) Directors who form a quorum are present or at which only two (2) Directors are competent to vote in the question at issue, shall not have a casting vote.

The meeting papers with accompanying notes and explanations shall be provided to the Board Members at least five (5) business days before the Board meeting to ensure the Board Members are well informed and have sufficient time to review the same as well as to seek additional information, clarification and advice, if required.

The Board may invite Senior Management, Company’s auditors and any other external advisors to attend the Board meeting, where necessary, to furnish the Board with the information, clarification and advice needed to assist the Board for any decision making.

10. Access to information and Independent Professional Advice

All the Directors are, whether as a full board or in their individual capacity, entitled to request and receive additional information/advice as they consider necessary and reasonable to enable them to make informed and independent decisions, including but not limited to obtaining:

(i)full and unrestricted access to any information pertaining to the Group;

(ii)full and unrestricted access to the advice and services of the Company Secretaries and Management; and

(iii)Professional independent advice, at the Company's expense.

11. Directors' Training and Continuing Education

In addition to the Mandatory Accreditation Programme as required by Bursa Securities, the Board members shall continue to undergo other appropriate training programmes to further enhance their professional skills and knowledge as directors of a public listed company and to keep abreast with regulatory changes and new development within the Group's business environment in furtherance of their duties.

The Board shall assess and evaluate the training needs of its Directors on a continuous basis and the Company Secretaries shall assist by organising internal or external training, seminar, workshop and briefing for the Board.

13. Disclosure of Interest/Conflict of Interest

Directors shall disclose their shareholdings and interest in the Company and the Group as well as interest in any contract or proposed contract in accordance with the relevant requirements of the Companies Act, 2016 of Malaysia, the Company's Constitution and the MMLR of Bursa Securities.

Every director who is interested directly or indirectly in any contract or arrangement or proposed contract or arrangement shall declare his/her interest to the Board as soon as he/she becomes aware of such contract or arrangement and such director shall not participate in deliberations concerning such contract or arrangement nor shall he/she cast his/her vote in respect of any matter arising therefrom. The declaration made by the Director will be recorded in the Minutes of the Board Meeting.

14. Financial Reporting

The Board aims to provide and present a balanced and meaningful assessment of the Group's financial performance and prospects, primarily through the annual audited financial statements, quarterly unaudited financial results as well as the Chairman's statement and review of operations in via the Company’s Annual Reports, to shareholders and other stakeholders of the Company.

The annual audited financial statements are prepared so as to give a true and fair view of the state of affairs of the Group and the Company in accordance with the Companies Act, 2016 and approved accounting standards in Malaysia.

The Board is assisted by the Audit Committee in overseeing the Group’s financial reporting processes and the quality of its financial reporting.

15. External Auditors

The Board has established a transparent and appropriate relationship with the Groups' external auditors in seeking professional assurance in respect of the financial statements of the Company in compliance with the accounting standards in Malaysia.

The Board has delegated to the Audit Committee to review the scope and results of the audit and its cost effectiveness as well as the independence and objectivity of the external auditors throughout the conduct of the audit engagement in accordance with the requirements of all relevant professional and regulatory bodies.

The Audit Committee shall be guided by the Board’s approved

Policy on Assessment of External Auditors.

The appointment of the external auditors is subject to the shareholders' approval at the general meeting of the Company. The external auditors have to retire during the Annual General Meeting of the Company every year and their re-appointment must be approved by the shareholders for the ensuing year.

16. Investor Relations and Shareholder Communication

The Board recognises the importance of having good and effective communication with the shareholders, investors and the general public, to ensure they have access to the information disclosed by the Company and to ensure the shareholders are well informed of all material developments and matters affecting the Group.

The following shall be established and implemented by the Company towards creating an effective communication with the shareholders, investors and the general public:

(a) To convene Annual General Meetings ("AGM") of the Company serving as principal forums of communication with its shareholders during which the shareholders are encouraged to participate in the question and answer session as well as to provide constructive feedback. Extraordinary General Meetings (“EGM”) may also be held during the year for any material transactions requiring shareholders’ approval.

(b) To hold press conference after AGM or EGM of the Company, where necessary.

(c) To release of financial results and other corporate announcements to Bursa Securities to provide the shareholders and the investing public with timely information of the Group's performance and operations and material information affecting the Group.

(d) To maintain regular communication between the Company and its shareholders, investors and the media via the Group’s corporate communication and investor relations activities.

(e) To conduct regular briefings with financial analysts and fund managers from time to time as a means of maintaining and improving investor relationship. Additional engagement with the financial analysts and fund managers may be held via teleconferencing.

(f) To provide up-to-date information on investor relations via the Company's website (www.wct.com.my).

(g) To participate in investors road shows/conferences held in Malaysia and overseas countries.

The Company is at all times mindful of the legal and regulatory framework governing the sharing and dissemination of information to its shareholders, investors and other stakeholders.

17. Review of the Board Charter

This Board Charter has been adopted by the Board and shall be reviewed and updated periodically by the Board as required.

This Board Charter is made available for reference in the Company's website at

www.wct.com.my.